12/30/2020 Market Analysis

General Market commentary

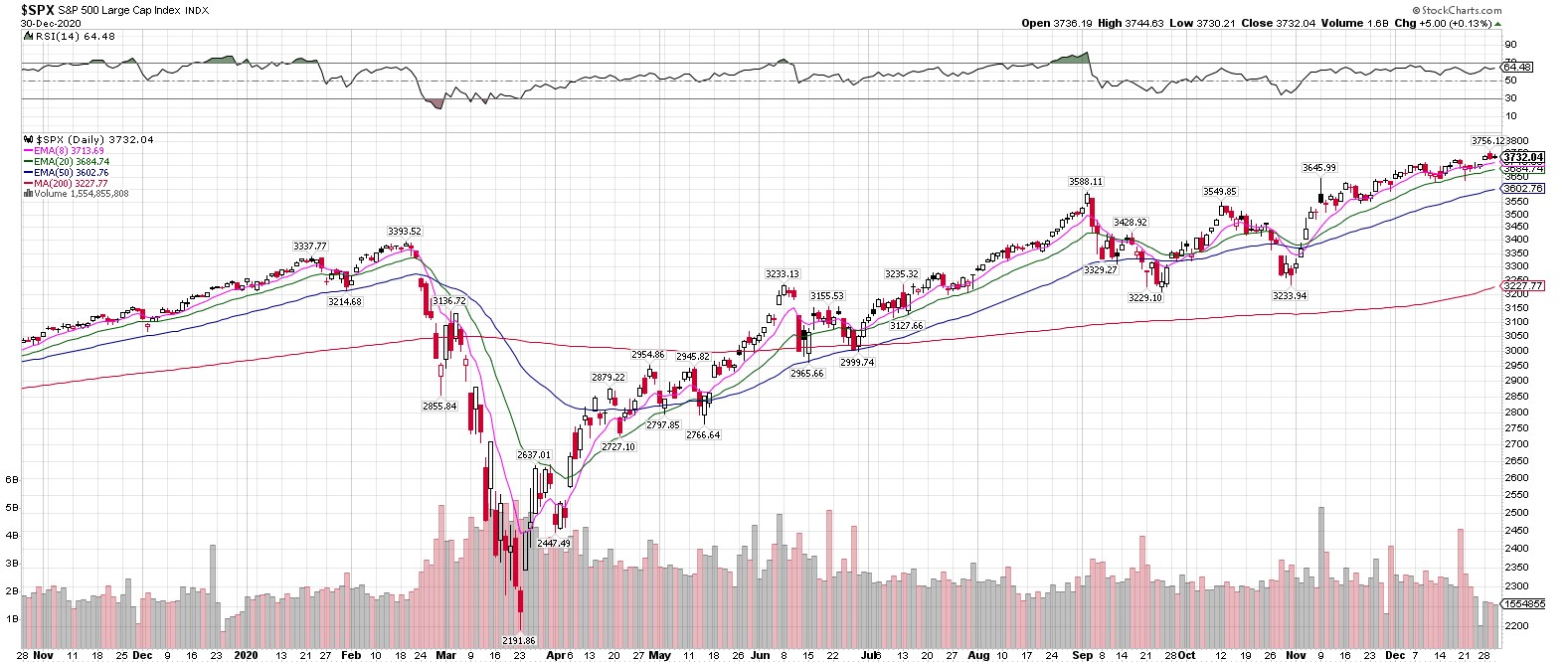

S&P 500 went inside today. The volume is light as year end approaching. The internal of the market is getting a little bit thinner as you can see below. If you are unfamiliar with $BPSPX indicator, please read this document: StockCharts Bullish Percent Index

.

S&P 500 went inside today. The volume is light as year end approaching. The internal of the market is getting a little bit thinner as you can see below. If you are unfamiliar with $BPSPX indicator, please read this document: StockCharts Bullish Percent Index

.

As you can see in the $SPX vs $BPSPX chart, the divergence is getting wider. This is another reason why we see the midterm risk is high.

Quantative market model signal

-

Midterm trend: moderately bullish

-

Midterm risk: high

Featured charts

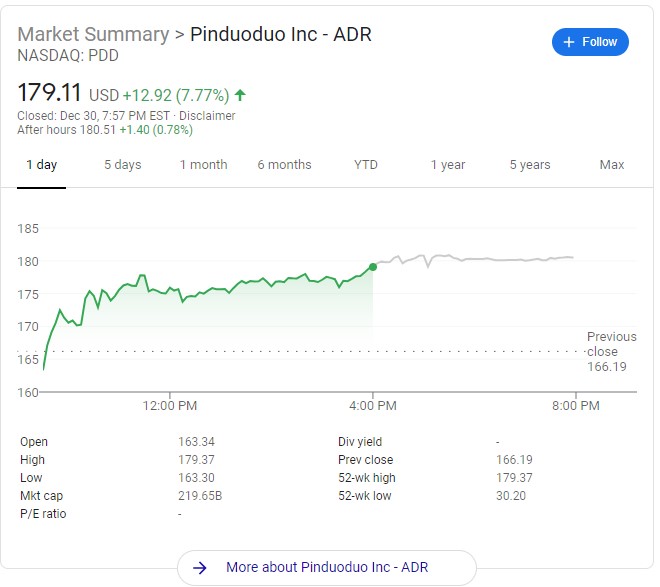

PDD

As we highlighted in yesterday’s market update, PDD closed up with another +7.77% today. This sustained buying proved our thesis that all the funds want China E-commerce exposure are under-allocated on PDD. We called for 200 price target in the near term and it might get there soon.

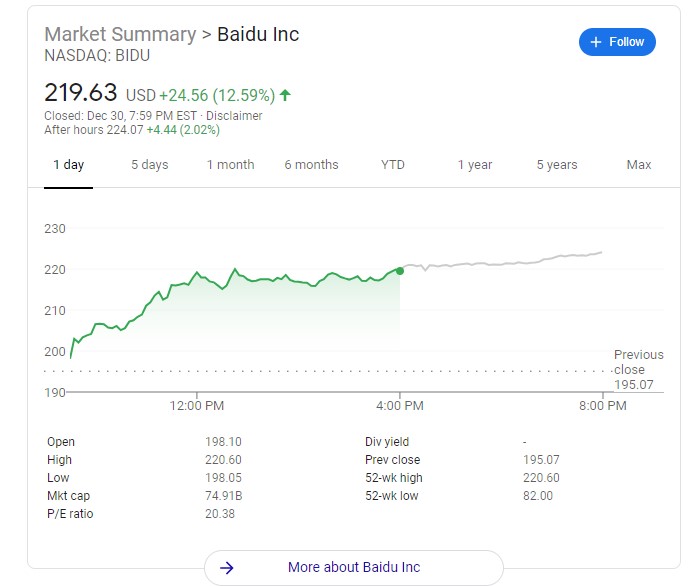

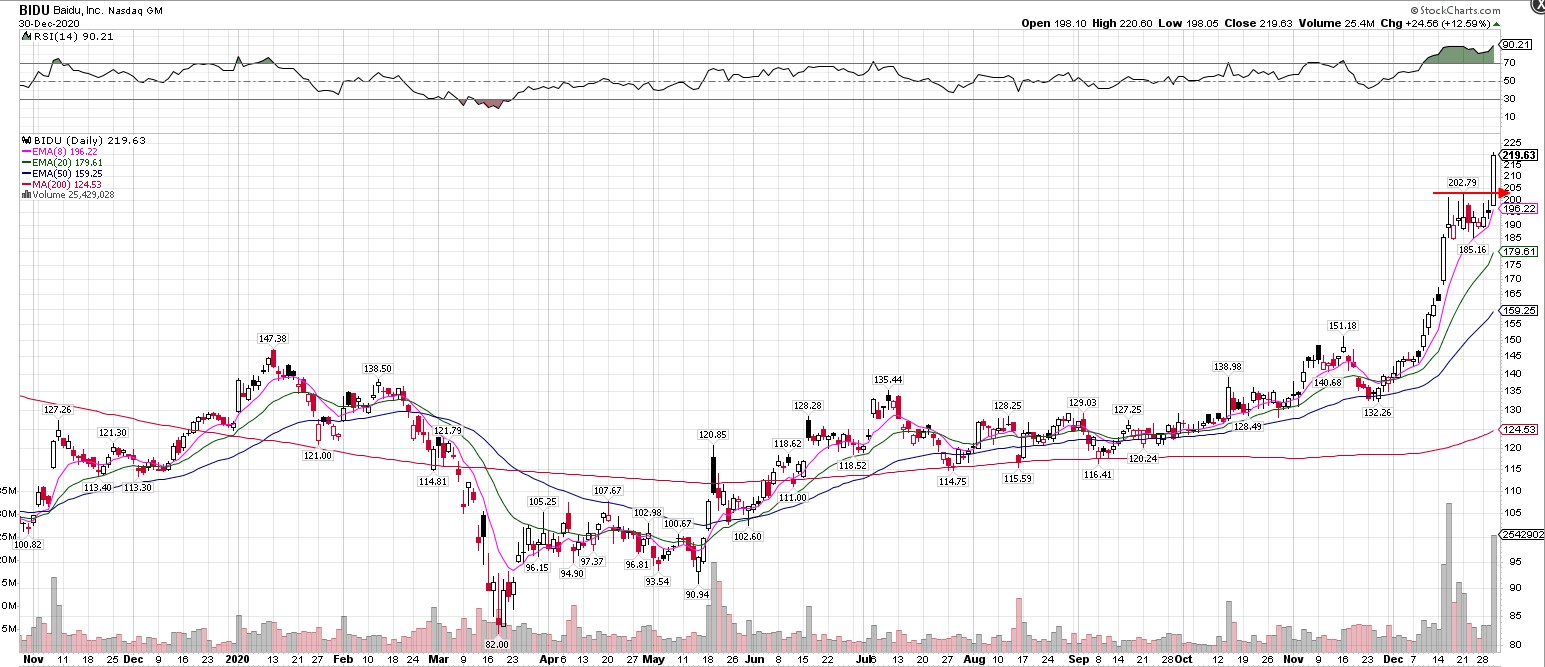

BIDU

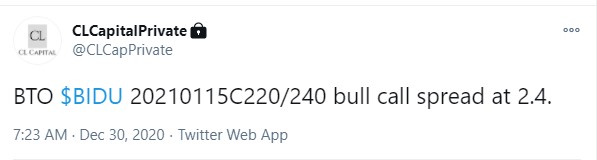

CL Capital had a fun day with Baidu. BIDU broke out of a short consolidation and closed up +12.59% today and gained another 2% in after hours. CL Capital entered BIDU 20201231C205 calls at 3. It hit 15 at close. That’s +500% gain in one day. We then entered 20210115C220/240 bull call spread as a safer play for our private members.

Needless to say after an hour and half those call spreads went +100%. We alerted our members to sell half and make the rest a free bet to manage risk.

These call spreads are now a free bet and theta neutral with 2 weeks to go. CL Capital believes this will be a great trade to wrap up 2020 and to start 2021 strong!

One final bonus for our patient readers: Remember to play what’s moving. This is the best way to compound your capital rapidly. The current theme in the market is clearly EV and China stocks :). As always, remember to manage your own risk!!!